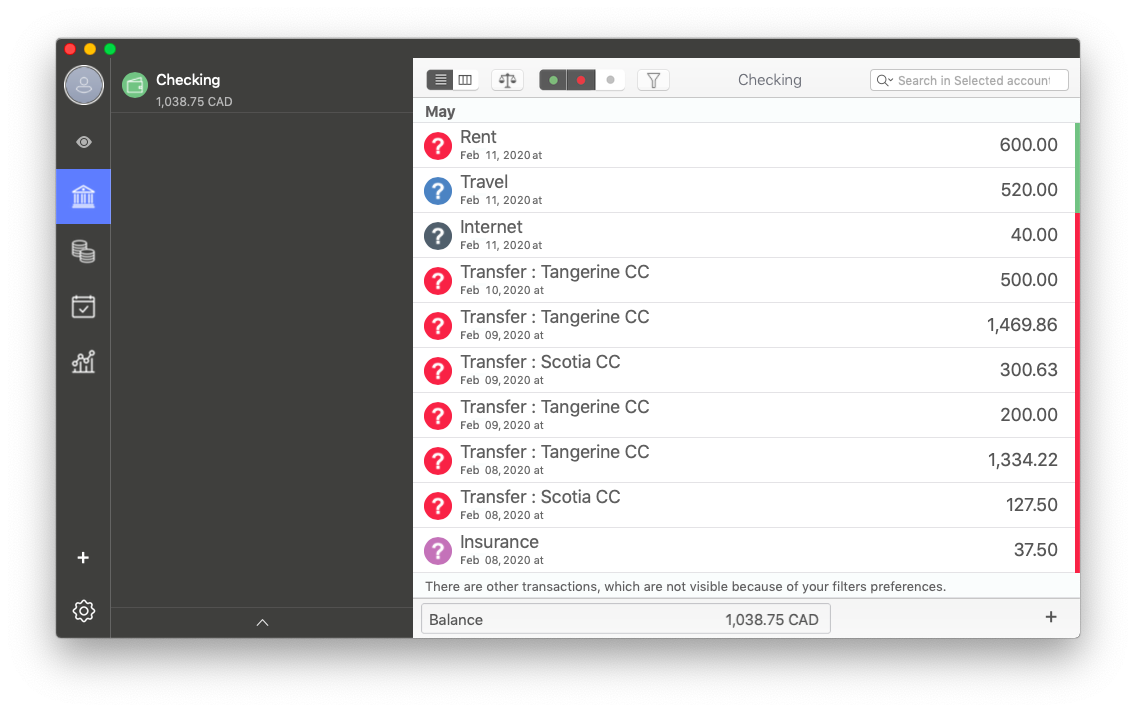

Does it sync automatically with New Zealand bank accounts? Yes Pros: If you want auto synching and to forecast your cash flow for 10 years to truly achieve FIRE, the paid plans start at NZ$9.95/month.

HOME MONEY MANAGEMENT SOFTWARE FOR MAC FREE

Pocketsmith offers the tools to make this easier, by allowing you to forecast a budget to help achieve your goals Know this: PocketSmith is free if you manually input your transactions and want to project your cash flow for 6 months ahead. If FIRE (financially independent, retire early) is on your radar, you must master this skill. Why we like it? PocketSmith offers the ability to forecast your cash flow. Whether you have two jobs or a day job and a few side gigs, track all your income in one place with PocketSmith. Most budgeting apps don’t accommodate more than one income PocketSmith does.

A budgeting module lets you schedule upcoming bills and payment due dates to get motivated.Spending limits help change behaviours.This means you can have a single view on where you're spending your money. mybudgetpal syncs with your bank accounts every day and automatically sorts your transactions into expense categories.

Spending limits are a feature (meaning you can save more and incur less unnecessary expenses by seeing where your money goes)ĭoes it sync automatically with New Zealand bank accounts? Yes Pros:.mybudgetpal gives you a complete view of your finances it tracks your spending so you can compare spending over different periods and isolate areas or habits that need attention.

Additionally, you don't need to be a member of the Booster KiwiSaver Scheme. In a nutshell, Booster's mybudgetpal is a program that that synchs with your bank account and is free to use.

0 kommentar(er)

0 kommentar(er)